Towne’s Two Cents

June 15, 2021 Edition

Monthly Blog: Top 3 ACH Payment Providers

I felt that ever since Covid hit us like a hurricane this past year, more and more companies are increasing their rates for mostly everything, including things that were considered FREE!

I have many clients, colleagues and even family ask me about providers that don’t charge a fee for accepting ACH Payments. They are becoming very rare! I know many people that have small businesses that accept ACH Payments instead of accepting credit cards. Everyone is trying to relieve the burden of their astronomical fees. As you all know, I am a QuickBooks ProAdvisor so I usually promote QuickBooks products. I have always promoted their ACH feature which was great because it was FREE to accept ACH Payments – you would just have to wait 3-5 days to receive your payment which wasn’t too bad. If you wanted the money the next business day, it would be a 1% charge or a maximum of $10 fee. I thought it was a great deal!

Well, a couple of months ago, they decided to make the 1% fee permanent and they have discontinued the FREE option. Since that happened, I have been connecting with different merchants to check what they offer & how it would benefit my clients that accent ACH Payments from their customers.

First, let me explain what an “ACH” is. ACH stands for the Automated Clearing House which is an electronic funds-transfer system run by NACHA (National Automated Clearing House) since 1974. This payment system provides ACH transactions for use with payroll, direct deposit, tax refunds, consumer bills, tax payments and many more payment services in the US.

If you follow me on social media, you must have read the article about ACH Payments about a week ago that I posted. If you would like to read it, click here: https://tipalti.com/ach-fees/

After researching a few merchants that can accept ACH Payments, I have found a list of a couple merchants that will save small business owners some money (if they process more ACH than credit card transactions).

The top 3 ACH Merchants that I have found are:

- www.meliopayments.com has no fees at all if it’s B2B (Business to Business). It connects right in QuickBooks and it’s great to make payments to your vendors and receive payments from your customers too. I highly recommend this one if you do business with other businesses.

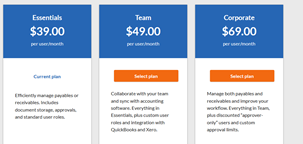

- www.bill.com doesn’t have a percentage for each transactions like how most merchants do, but it’s more like a subscription basis. They have 3 tiered options which include ACH for receiving payments from customers and sending payments to vendors:

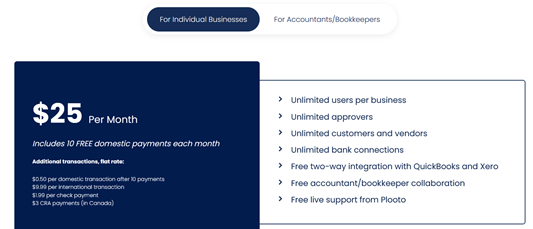

- www.plooto.com also has the same concept as far as the monthly subscription rather than the percentage of the transaction. They have a lower monthly subscription and has 10 FREE domestic payments every month – anything over the 10 transactions, it would be .50 per transaction. I think it’s still a great deal, depending on your volume of monthly transactions.

I hope the information that I have provided to you all was helpful & insightful. If you have any questions on any part of this blog, I will be happy to answer them.

Thank you all for reading!

Dolly Towne, CEO & Growth Advisor

Bookkeeping Towne, LLC

Website: www.bookkeepingtowne.com

Email:dolly@bookkeepingtowne.com

Phone: (401) 474-5229